Form W-2/1099 Filing Requirements for the

District of Columbia

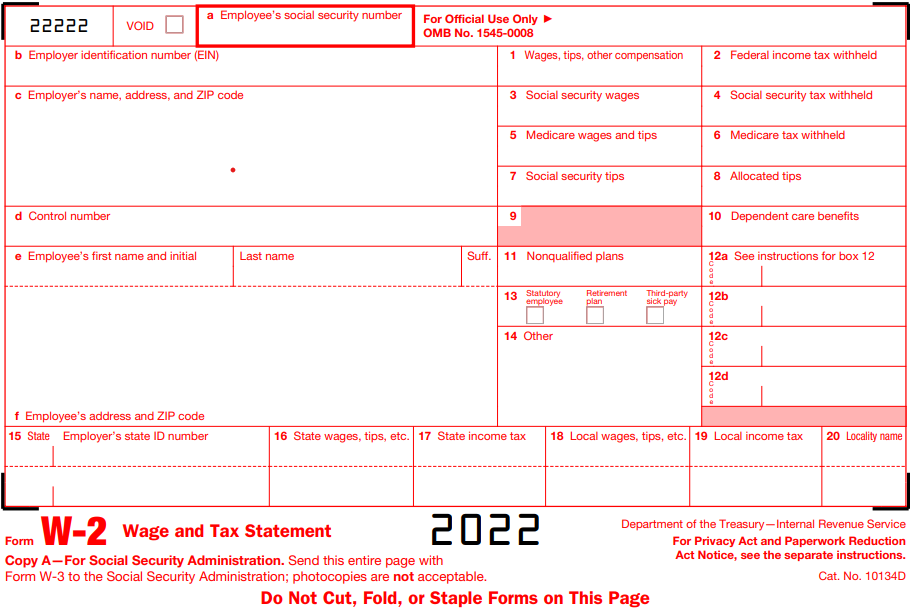

Form W-2

The District of Columbia mandates the filing of Form W-2. Form W-2 is used to report the employees’ wages and taxes withheld from their paychecks. Remember, you need to file Form W-2 with District of Columbia only if there is a state tax withholding.

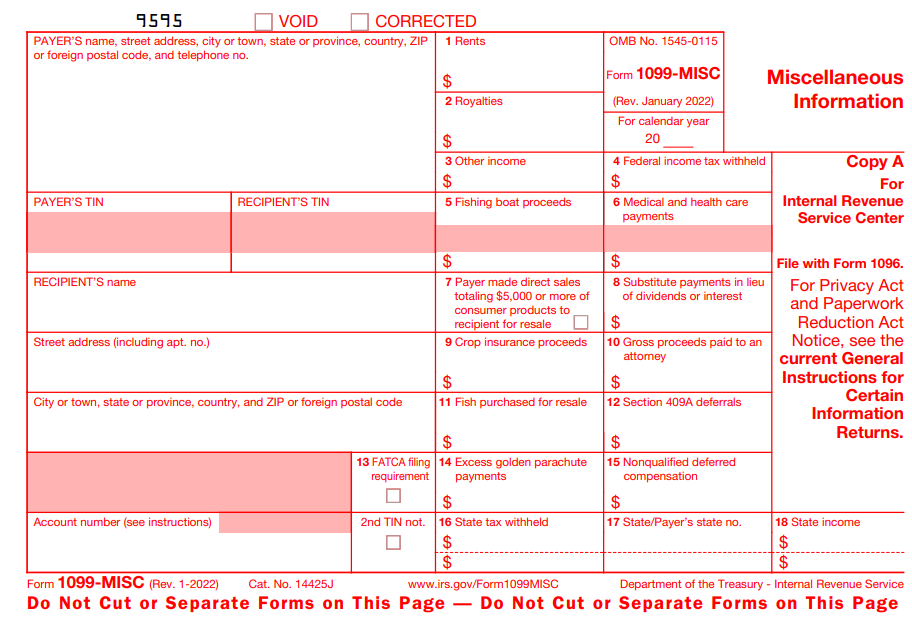

Form 1099

The District of Columbia mandates the filing of Form 1099. There are variants of 1099 Forms available (such as MISC, INT, DIV, R, S, B, PATR) which is used to report the payments made to independent contractors, rents, interest, etc. You must file the required 1099 forms directly with the District of Columbia. The State doesn't require any reconciliation Form to be submitted along with the 1099 Forms.

Form 1095-B/C

After the elimination of the federal individual mandate, the District of Columbia passes its own individual mandate for the filing of Form 1095-B/C. The employers in the state (or) out of the state need to provide their employees and their dependents an Minimum Essential Coverage. You must file Form 1095-C (or) Form 1095-B with the State along with the Form 1094-B/C before the deadline.

What types of 1099 forms does the District of Columbia require?

The District of Columbia state requires the following 1099 forms to file,

| Form 1099-NEC | Form 1099-MISC | Form 1099-INT |

| Form 1099-DIV | Form 1099-R | Form 1099-B |

| Form 1099-G | Form 1099 K | Form 1099-PATR |

Deadline to File Form W-2/1099 for the

District of Columbia

Form W2

W-2 tax returns are due by

January 31.

Form 1099

1099 tax returns are due by

January 31.

Form 1095-B/C

Furnishing employee copies - March 02

Submit Form 1094 & 1095-B/C with the State - April 30

Don't wait to file your tax return until the last day. Chances are high for you to miss the deadline and also you may be subject to penalized.

Start Filing your Returns Now

What Information is Required to File Form W-2/1099 with the

District of Columbia?

Information about your Business:

- Employer Identification Number.

- Business Name, Address.

- Business's State Tax ID Number.

Information about your Employee/Recipient:

- Employee/Recipient SSN.

- Employee/Recipient Name, & Address.

- Total Federal & State wages/payments.

- Total Federal & State Taxes Withheld.

You can start filing your tax returns for both the Federal and District of Columbia agencies once you have prepared all the mentioned information in your database.

Why Districtofcolumbiataxfilings.info is the best solution to file your W-2/1099/1095 Returns?

Districtofcolumbiataxfilings.info is one of the authorized e-file providers and we ensure that your returns transmitted will be 100% safe and secure. With our cloud-based software, you can view or access your returns at any time and anywhere.

Bulk Upload

You can upload multiple data of your Business/Recipients at a single instant with our Bulk Upload template.

Print + Postal Mail

We will print and send the hard copies of your Form to your employees/recipients on behalf of you through our postal mailing feature.

Form Corrections

If you have made any errors on the previously filed return you can easily correct the errors with our software. Even though, if you have filed your W-2 Form with other providers and made any mistake you can correct the return with us.

Prior Year Tax Filing

If you miss filing your returns for the prior year, then you’re in the right place. You can also file tax returns for the Tax Year 2021 & 2022 with our Software.

If you have any queries in filing your W2/1099 returns, don’t hesitate to contact our support team and we are ready to help you at any stage of your e-filing process. Contact us via email (support@taxbandits.com) or call (704) 684-4751.

File W2 online and 1099 Forms online and 1095 Forms online with our software and get Federal, State Filing, Postal Mailing etc., at just $4.94/Form.

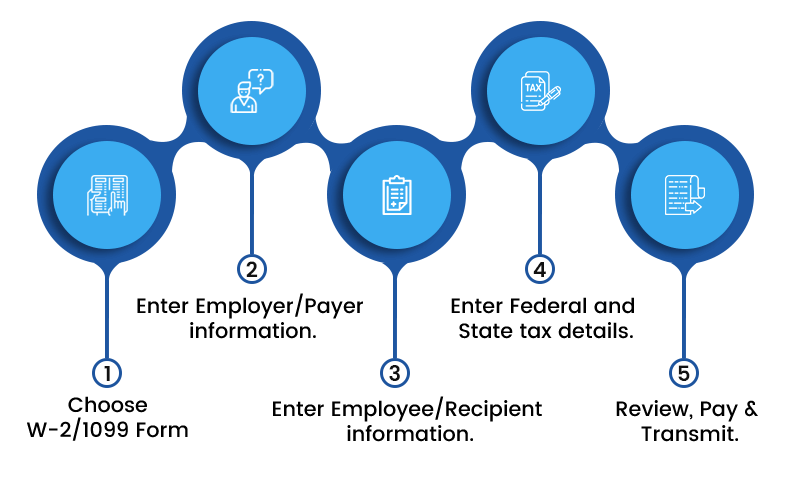

How to File Form W-2/1099/1095 for District of Columbia

Just create a free account with our e-filing Software & follow the below simple steps to complete your W2/1099/1095 tax returns easily with our Software.

- Choose the W-2/1099/1095 Form that you need to file.

- Enter Employer/Payer information.

- Enter Employee/Recipient information.

- Enter Federal and State tax details.

- Review, Pay & Transmit.

File Your Tax Returns in few steps and stay compliant with the Federal & State.

| Where to mail District of Columbia state filing Form 1099/W2? | |

|---|---|

| District of Columbia Form W-2 Mailing Address | District of Columbia Form 1099 Mailing Address |

|

Form W-2 Office of Tax and Revenue, 1101 4th St., SW, FL4, Washington, DC 20024 |

Form 1099 Office of Tax and Revenue, 1101 4th St., SW, FL4,s Washington, DC 20024 |

District of Columbia Paystub Generator

Generate Paystubs for employees and contractors in District of Columbia. Just enter the basic information, our

District of Columbia paystub generator will automatically calculate the taxes accurately.

Get Your First Paystub for Free

Generate paystubs on the go by using our paystub generator app.

Get started to File your Form 1099/W2/1095 with our cloud based software

Contact Us

If you need any assistance for District of Columbia State Tax Filings, contact our awesome, US-based support team. We're here to help you to complete your Forms easily.

You can reach us via phone, live chat, and through our 24/7 email support.

.jpg)